Please fill in the contact form to get your free copy, request more information or ask a question.

Why paying off your mortgage is one of the best savings plans you can have...

- A savings account typically pays you less interest than what you pay for your mortgage. Imagine a scenario when you have a mortgage of $200,000 and a savings account of $200,000. Does it make sense?

- Profit on a savings account or investment are subject to income tax which can be a very significant portion of your earnings.

- Paying off your mortgage means more equity in your home. This equity profit is TAX FREE!

- The stock market is subject to a certain amount of risk. Paying off your mortgage and saving interest payments is a risk free strategy.

The banks hate what we teach you!

Why didn't my bank tell me about this?

Like any other business your bank works for profit. If the bank can take more, the bank would - like any other business. There are lots of financial products being offered by the bank. The first one offered to you would very likely be the most expensive one for you and the most beneficial for the bank.

Do I need to commit to a new a new bank?

When you use FastTrackMyMortgage™ systems you don't have to leave your bank or refinance. You will still give them your business but in another way - a way that work in your favour while satisfying the demands of your mortgage provider.

How is your investment portfolio? Do you have a retirement plan?

If you are like most people you don't have many investments besides your house. You are living pay check to pay check and your retirement dream seems vague.

The way to ensure you have a retirement plan is to build equity!

You need to pay off your home as fast as you can. By doing so you pay less interest to the bank and thus create your own saving plan tax free.

If you paid off your mortgage 10 years earlier by the time the original amortization period has passed you will have a savings account equal to 10 years of your original mortgage payment - plus interest!

So why don't you start it today?

How can anyone get rid of debt quicker?

At Fast Track My Mortgage™, we think homeowners don’t have to refinance mortgages or spend thousands of dollars on software to take advantage of the amazing opportunities acceleration programs have to offer.

You can set up your own acceleration program to pay off your mortgage faster in few easy steps.

Take control, keep your strategy flexible and don’t pay fees – we’ll show you how.

We have several levels of education for those who feel comfortable setting up a program on their own to those who need a kick start and a bit of guidance along the way.

All our programs come with a free evaluation so you can feel comfortable that an acceleration program is right for you.

Mortgage accelerator programs are not new. Homeowners in the UK and Australia have been saving for years with this 100% legal strategy and now this concept is taking North America by storm. Specialized mortgage brokers and financial institution have popped up, as well as firms offering accelerator software. Most of the claims made by these companies seem too good to be true – but they are true – you can save thousands of dollars and years of interest by restructuring how you pay your debts. The downside is that these mortgage brokers will ask you to refinance your mortgage and the software will cost you thousands of dollars – expensive steps we feel you don’t need to take to get the amazing savings an accelerator program can offer each and every homeowner.

How does the Fast Track My Mortgage™ System work?

Smart consumers know that they will pay double (or more) the purchase price of their home on a traditional mortgage(about 30 years).

We want to show you how to break this cycle of financial drain—the Fast Track My Mortgage™ system.

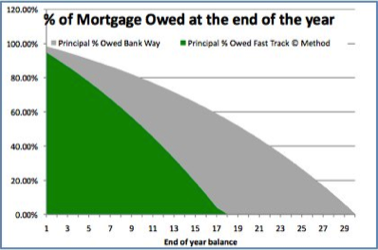

The Fast Track My Mortgage™ system rapidly reduces the principal of your mortgage, in turn reducing the interest you will pay on your loan and the time it takes to pay this loan off. Your mortgage can now be paid off in as little as 1/2 to 1/3 the time, with little to no change to your lifestyle or refinancing of your existing mortgage.

The Fast Track My Mortgage™ system is not a bi-weekly payment or debt roll-down system!

It’s a powerful new approach that gives homeowners the flexibility needed to accelerated financial freedom.

We’re not just doing business! We care about your family.

Understanding that each person has different needs, requirements and dreams is our specialty. We are home owners too.

Our products and services are designed to give you the customized treatment you deserve.

Stages of learning:

- Understanding - you have to understand the system, the benefits and how it works before you are ready to make a move.

- Confirmation - we look at what your goals and constraints are, and customize our system to your situation.

- Determine Solution - we work together to create a plan and put a schedule together that works with your lifestyle.

- Implement Solution - we follow you step by step to make sure you are on the right track.

- Analyze and Improve - as life changes day by day there may be room to improve your situation even further.

The Fast Track My Mortgage™ system can help repay the same mortgage in 11.3 years with a total repayment of $181,217. An incredible savings of $89,566 is realized.

This huge savings was earned without:

- the homeowner earning a bigger salary or gaining a windfall of cash,

- refinancing the mortgage - the same interest rate still applies,

- making sacrifices in the homeowners current standard of living.

The Fast Track My Mortgage© system is simply THE fastest ways to repay your mortgage and take control of your financial future!